3 banks under the Yamaguchi Financial Group Invests in One of World’s Largest, Japan’s Largest SIB Fund, Administered by Dream Incubator

Dream Incubator Inc. (headquartered in Chiyoda-ku, Tokyo; Representative Director & COO: Takayuki Miyake; “DI”) hereby announces that it signed a contract with The Yamaguchi Bank, Ltd. (headquartered in Shimonoseki City, Yamaguchi Prefecture; President & Representative Director: Narumasa Soga), The Momiji Bank, Ltd. (headquartered in Hiroshima City, Hiroshima Prefecture; President & Representative Director: Kouji Oda) and The Kitakyushu Bank, Ltd. (headquartered in Kitakyushu City, Fukuoka Prefecture; President & Representative Director: Mitsuru Kato) which are subsidiaries of Yamaguchi Financial Group, Inc. (headquartered in Shimonoseki City, Yamaguchi Prefecture; Representative Director, President & Group CEO Keisuke Mukunashi) to invest in the social impact bond fund it administers, the Next Rise Social Impact Fund Investment Limited Partnership (hereinafter the “fund”).

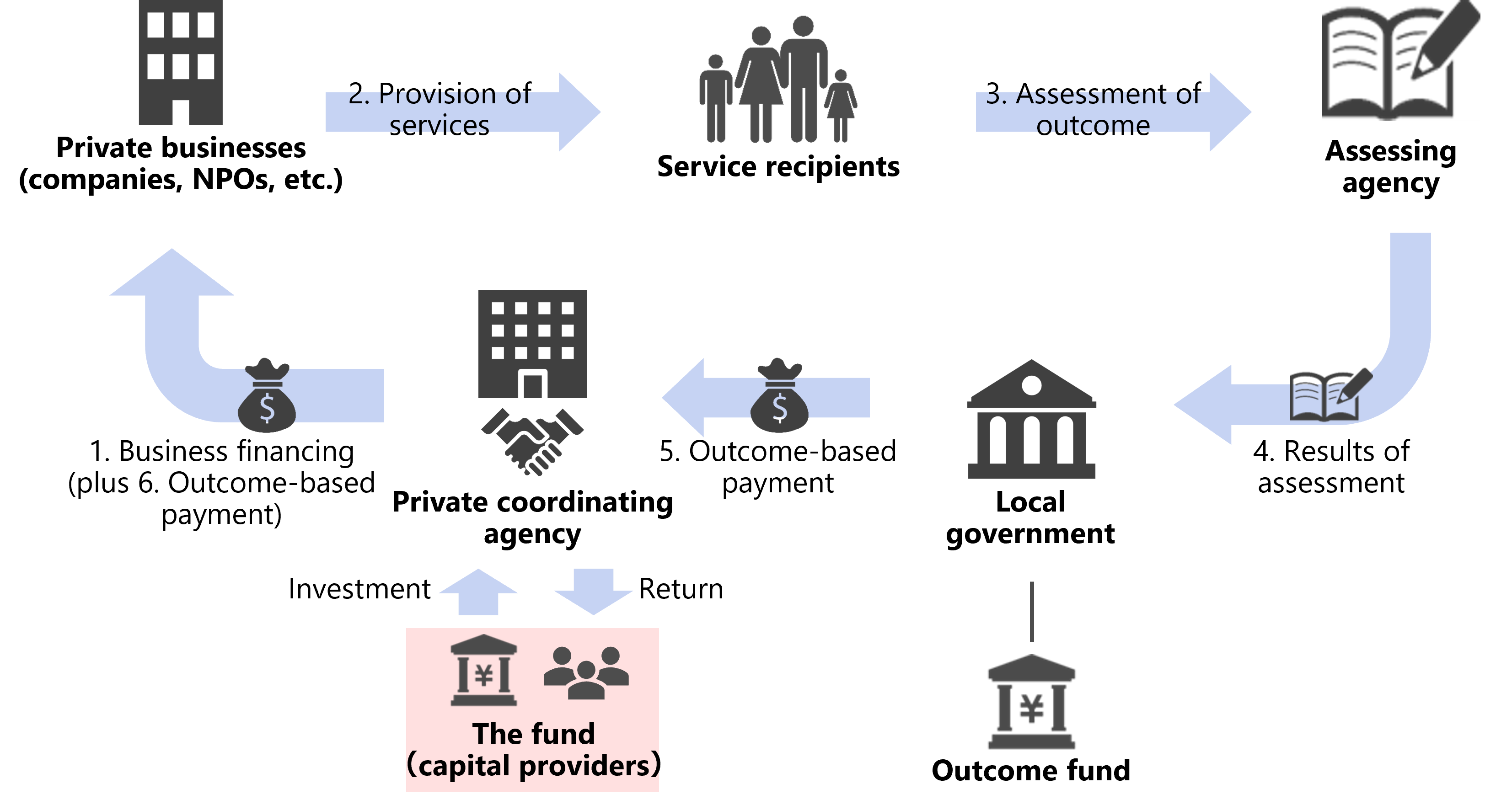

Social impact bonds (SIBs) are outcome-based financing schemes in which a government utilizes private-sector funds. They have drawn attention in recent years as a new impact finance scheme for addressing social issues. SIBs are well suited to business areas where steps can be taken to prevent issues that are likely to occur in the future, such as long-term care and preventative medicine, public facilities and infrastructure, and healthcare. DI expects SIBs to be used to help local governments reduce their spending over the longer term.

The fund aims to address social issues in a sustainable manner by providing stable financing for the activities of private-sector businesses tackling issues in the areas of long-term care and preventative medicine, public facilities and infrastructure, and recycling, among others, while reducing the business risks to companies associated with outcome-based financing. It is one of the largest SIB funds in the world and the largest fund in Japan. DI intends to make a greater social impact through the fund. The call for additional investment in the fund will be closed.

DI is moving forward with concrete discussions and initiatives with local governments and companies in relation to SIBs, including an SIB project aimed at reducing the number of seniors requiring nursing care in Toyota City. As Japan’s leading* SIB administrator, DI will help expand SIB financing in Japan. At the same time, DI will continue seeking to address social issues by drawing on its track record of bringing together the power to generate ideas and the power to gain partners in the development of new business, thus fulfilling its mission of “creating businesses and changing societies.”

* DI’s SIB fund is the largest in Japan. The SIB project aimed at reducing the number of seniors requiring nursing care in Toyota City is also the largest in Japan in terms of scale, at around 500 million yen (As of August 31, 2022, based on the pay-for-success business case study report by Japan’s Cabinet Office).

Fund Outline

| Name | Next Rise Social Impact Fund Investment Limited Partnership | |

| Location | 3-2-6 Kasumigaseki, Chiyoda-ku, Tokyo | |

| Launch date | July 1, 2021 | |

| Fund size | 4.2 billion yen | |

| Investors | Dream Incubator Inc. Development Bank of Japan Inc. Nippon Life Insurance Company Mitsui Sumitomo Insurance Company, Limited The San-in Godo Bank, Ltd. The Yamaguchi Bank, Ltd. The Momiji Bank, Ltd. The Kitakyushu Bank, Ltd. DI Social Impact Capital Inc. (wholly owned subsidiary of DI) |

|

| General partner | Name | DI Social Impact Capital Inc. |

| Location | 3-2-6 Kasumigaseki, Chiyoda-ku, Tokyo | |

| Representative | Takayuki Miyake, Representative Director | |

| Business | Managing assets of an investment partnership | |

| Capital | 50 million yen | |

| Fund duration | 10 years | |

Structure of SIBs, positioning of the fund

PDF of this press release

Media Contact

Dream Incubator Inc.

TEL : 81-3-5532-3200

Email: info@dreamincubator.co.jp